DreamsNex

DreamsNex Top Construction Company in Bahria Town Karachi & Fastest Growing Builder of Karachi

DreamsNex builders a leading construction company in the city of Karachi is surprisingly the gateway to all your construction solutions. Our company has always focused on the needs and financial capabilities of customers in order to recommend the best solution that suits them. DreamsNex is a leading construction company that provides you with complete information about the construction in Bahria Town Karachi.

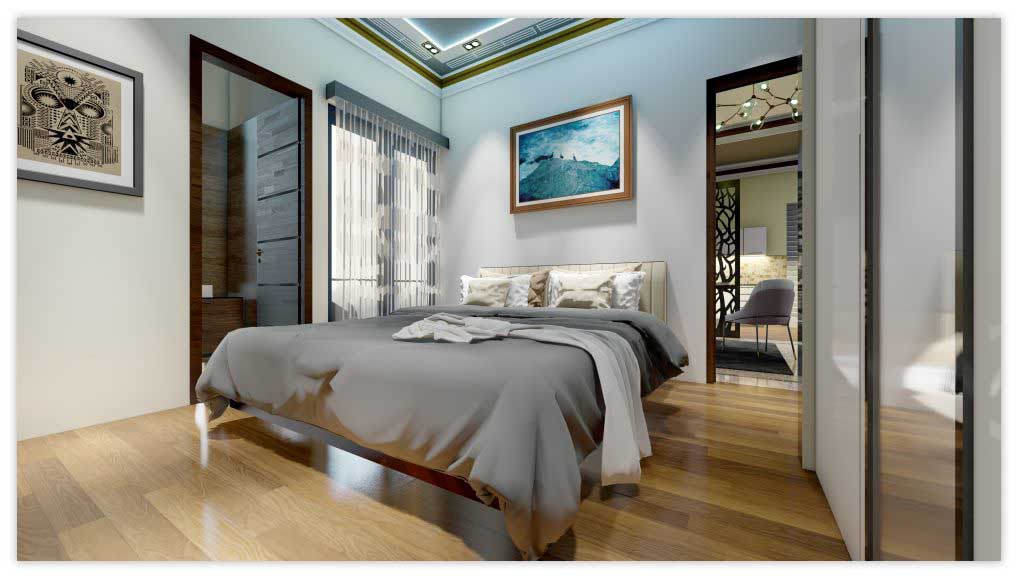

This detail consists of Sales and Construction of Villas including their prices. We deal with all types of properties in Bahria Town Karachi. We provide legal information as a guide for our clients to fulfill their requirements. We provide facilities to construct Villas and Commercial Projects for our clients. Whenever you select consultants for your dream home, we will ensure that your home is both superb and charming. We deal with all types of Luxury villas in Bahria Town Karachi.

CEO MESSAGE

“On our prosperous platform, the CEO of DX and Salaam Estate & Builders Saifullah welcomes you. It is very heart-warming to being regarded as the CEO of this victorious platform. I love to take on challenges since my childhood and in front of the eyes of the people to fulfill them in an authentic way. Due to that reason I have completed a lot of challenges in this ideal platform and succeeded. The only thing that I prioritize is the satisfaction of my customers and my team as well.”

Saif Ullah

C.E.O DreamsNex

Contact support

Sometimes you need a little help. Don't worry, We're here for you.

Follow Our Blogs

Meet Our Team

Client's testimonials

Contact Us

Pakistan Office

Office no.1007 10th Floor Dominion Business Centre 1, Bahria Town Karachi, Karachi.

Opening Hours

Mon to Sat: 11:30am – 07:30pm

Sunday: Closed

info@dreamnsnex.com

Bahria Town Karachi Office

Office # 1007, Business Dominion Center 1, Bahria Town Karachi Pakistan.

UK Office

225 Cranbrook Road, Ilford, London , Uk IG1 4TF